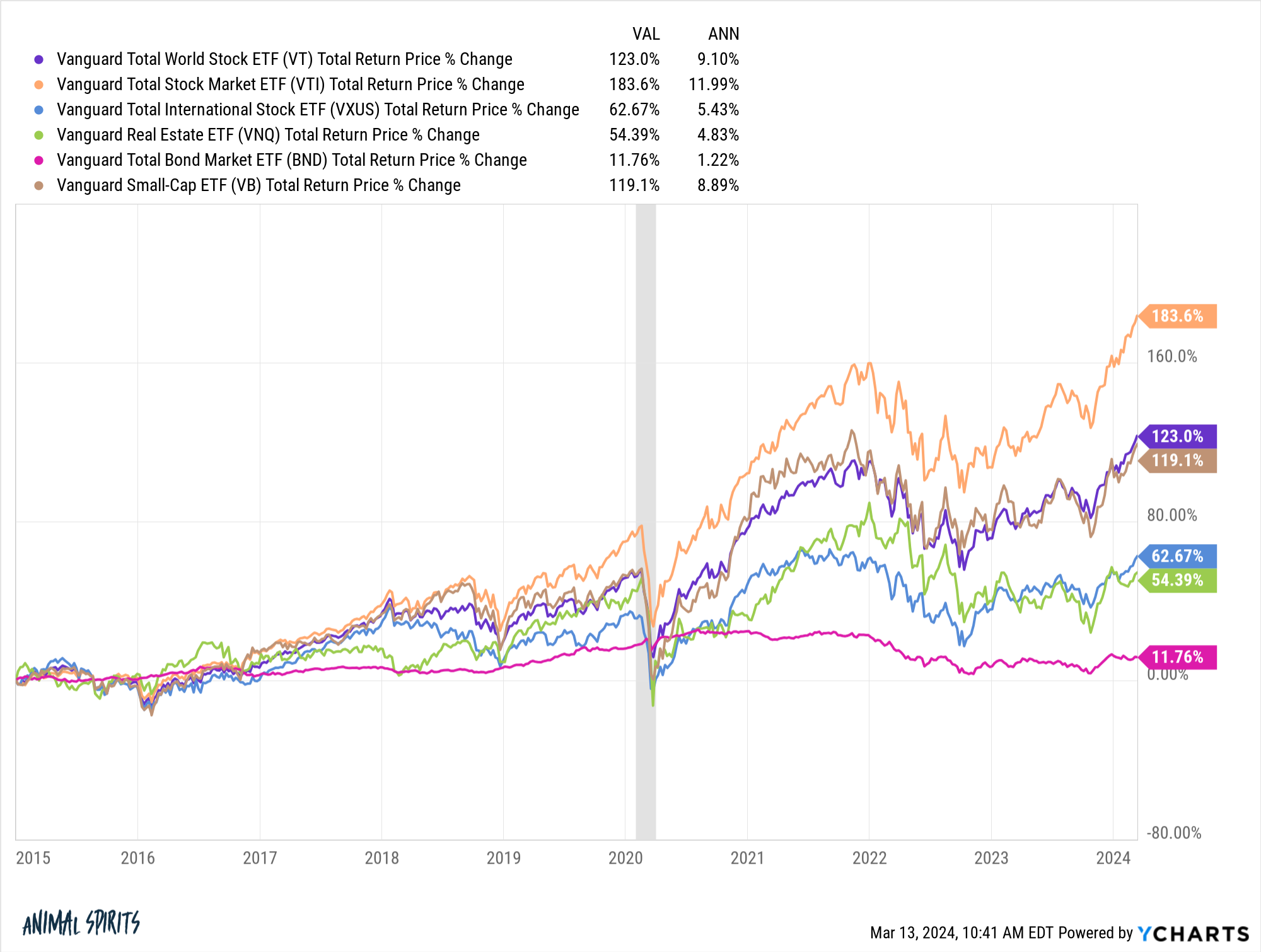

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Recent Post

- Hospital Housekeeping Jobs In Chicago Il

- Ups Locations For Amazon Returns

- Black Underneath Blonde Hair

- Santioks

- Bagoday Crochet

- Fexed Drop Off Locations

- Imdb Chief Of Station

- Dubois County Obituaries

- Ebay Motors Golf Carts

- India Vogue Horoscope

- Rent To Own Homes In North Little Rock Ar

- Free Police Scanner Local

- At N T Down

- Irs Careers

- Yellow Pill K 102

Trending Keywords

Recent Search

- Hospital Jobs For 18 Year Olds

- Shooting In North Charleston Sc Today

- Walmart Longview Tx Vision Center

- Lkq Pick Your Part Sun Valley

- Shuttle Driver Vacancies

- Cruise Critic Boards Princess

- High Top Dread Braids

- Arrest Org Lynchburg Va

- Comenity Apy F2

- Beige Trash Can

- Low Hair Temp Fade

- Food Lion Apps

- Childrens Comenity

- Zillow Greenville Sc Real Estate

- Best Sports Photos Ever

_14.jpg)