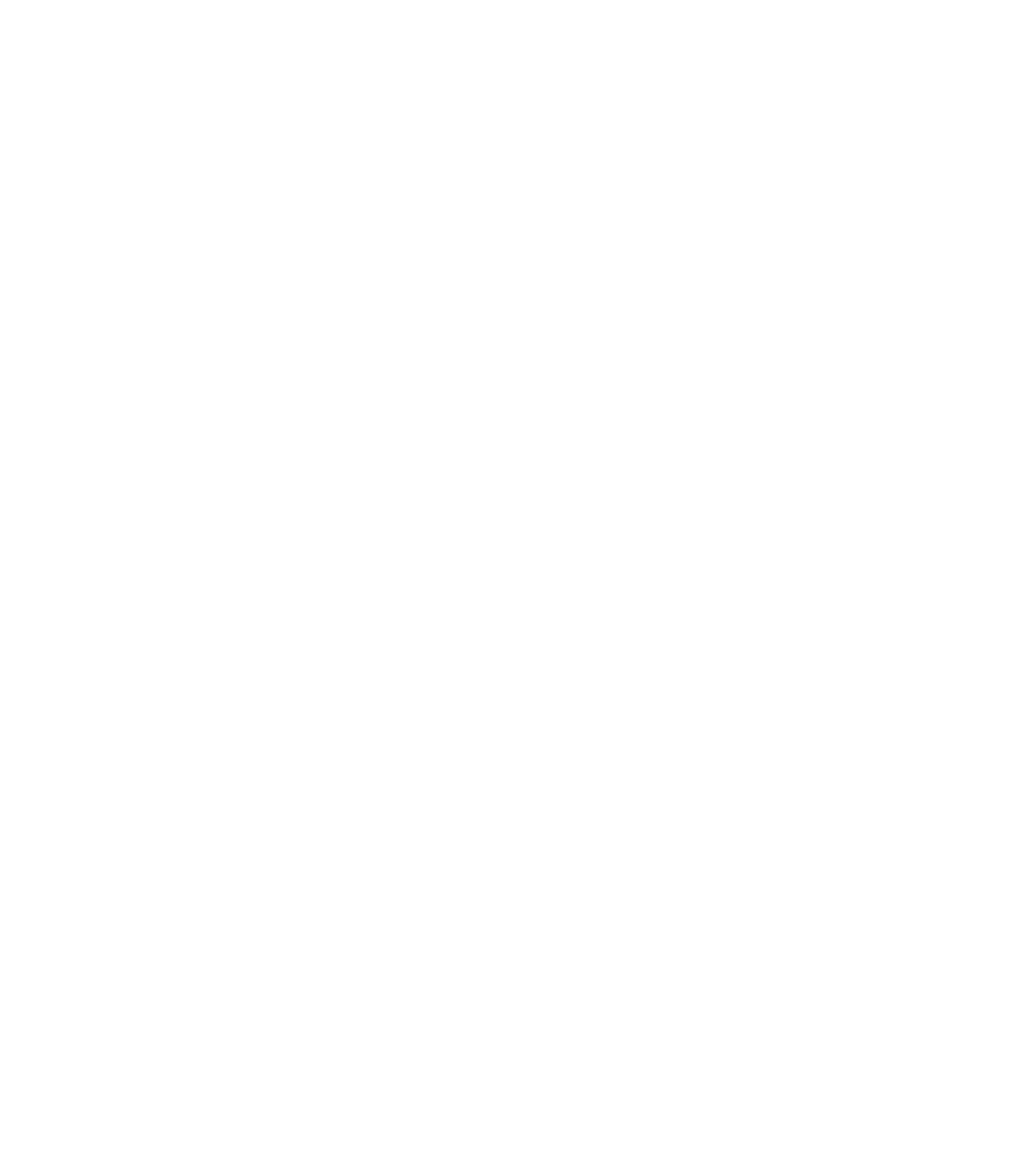

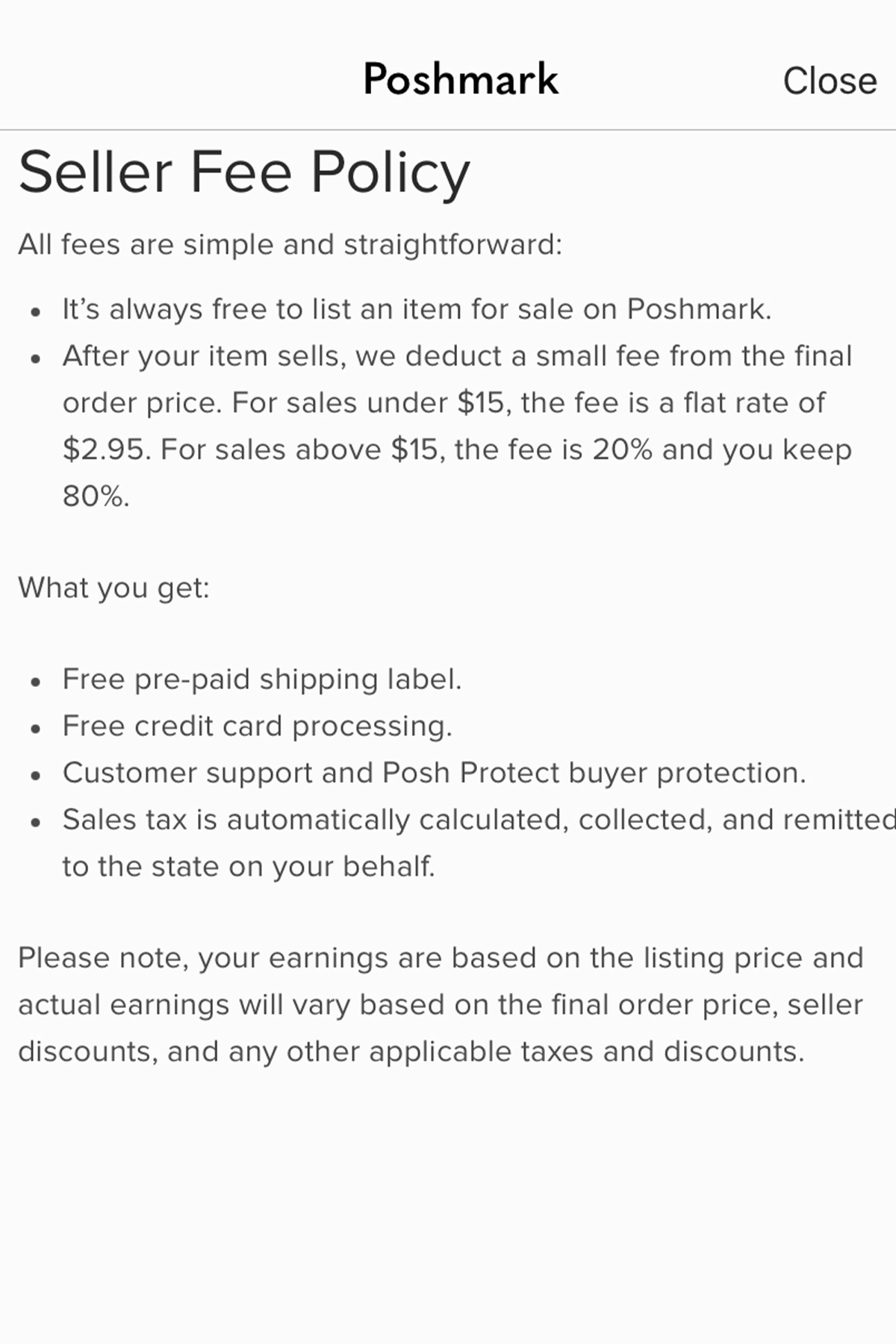

Webthe irs defines gross sales as the total amount buyers have paid before expenses are subtracted. Expenses may include cancellations, refunds, and any fees, such as. Websep 23, 2021 · with these new rules, for example, if sold $601 worth of items in 2022, even in a single transaction, the online marketplace and payment processor is required to file. Webjun 21, 2023 · as an online marketplace, poshmark is required to report sales if your sales were over a certain threshold to the irs. This means that if you're a seller on poshmark,. Webfeb 16, 2023 · if you sell items on poshmark and earn over $600 in a year, poshmark is required by law to send you a 1099 form to report your earnings to the irs. Webfor the 2023 tax year, poshmark is required to provide any seller with $20,000 or more in gross sales and 200+ transactions on our platform during the 2023 calendar year with a. This threshold requirement is in place for the following states:

Recent Post

- December 21st Sunset

- Blue Postal Drop Box Near Me

- Mta Bus Time B11

- Staple Ups Drop Off

- Indeed Jobs Fort Worth Tx

- Ccspayment Scam

- Greensboro Indeed

- Grubb Funeral Home Wytheville Va

- Ardmore Aaa Vehicle Registration Fee

- Airbnb Monthly Rentals

- Baytown Jail

- Elizabeth Malmstrom Obituary Branchville Nj

- Springfield Mo Zillow

- Zillow Palm Beach Gardens

- Wieting Funeral Chilton

Trending Keywords

Recent Search

- Buy Sell Trade North Ms

- Celebritymoviearchives

- Panama City Beach Real Estate Zillow

- Cslb License Search

- Chase Bank Pre Approval

- R Starwarsbattlefront

- Boston To Sydney Goodle

- Uconn Bursars Office

- Tractor Supply Company Trailer Tires

- General Hospital Celebrity Laundry

- Script Ware

- Anonib Al

- U Haul Locations Near Me

- Brinsfield Funeral Home Leonardtown Maryland

- Best Nba Centers Current

![[YALAYI] 2023.10.17 NO.1099 Youthful And Beautiful - V2PH [YALAYI] 2023.10.17 NO.1099 Youthful And Beautiful - V2PH](https://cdn.v2ph.com/photos/kP4RQXnwWrI_uaZ8.jpg)

![[YALAYI] 2023.10.17 NO.1099 Youthful And Beautiful - V2PH [YALAYI] 2023.10.17 NO.1099 Youthful And Beautiful - V2PH](https://cdn.v2ph.com/photos/UaDJUwLD0Z_RL0Ap.jpg)